santa clara county property tax rate

Skip to Main Content. 1110 of Assessed Home Value.

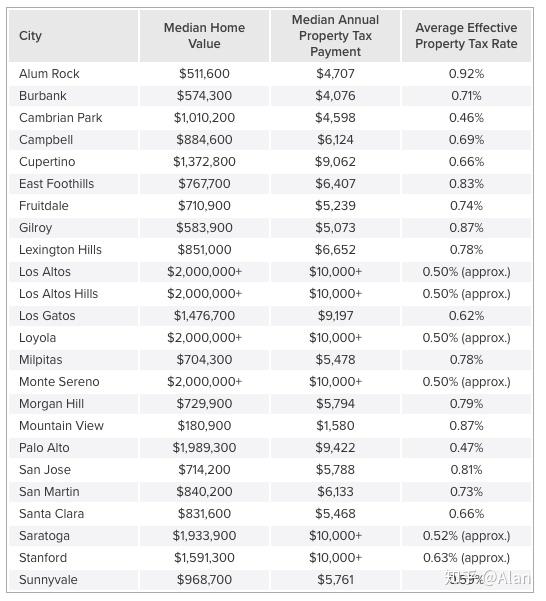

Los Angeles Property Tax Which Cities Pay The Least And The Most

With our resource you will learn helpful facts about Santa Clara property taxes and get a better understanding of what to anticipate when it is time to pay.

. For comparison the median home value in Santa Clara County is. Tax Rates by Tax Rate Area Numbers TRA. The bills will be available online to be viewedpaid on the.

0740 of Assessed Home Value. The median property tax also known as real estate tax in Santa Clara County is 469400 per year based on a median home value of 70100000 and a. Every entity establishes its.

Santa Clara County California. 70 West Hedding Street East Wing. 1 assessed-value property tax.

If you are considering taking up. 408 299 5500 Phone 408 297 9526 Fax The Santa Clara County Tax Assessors Office is located in San. Santa Clara County property tax rate.

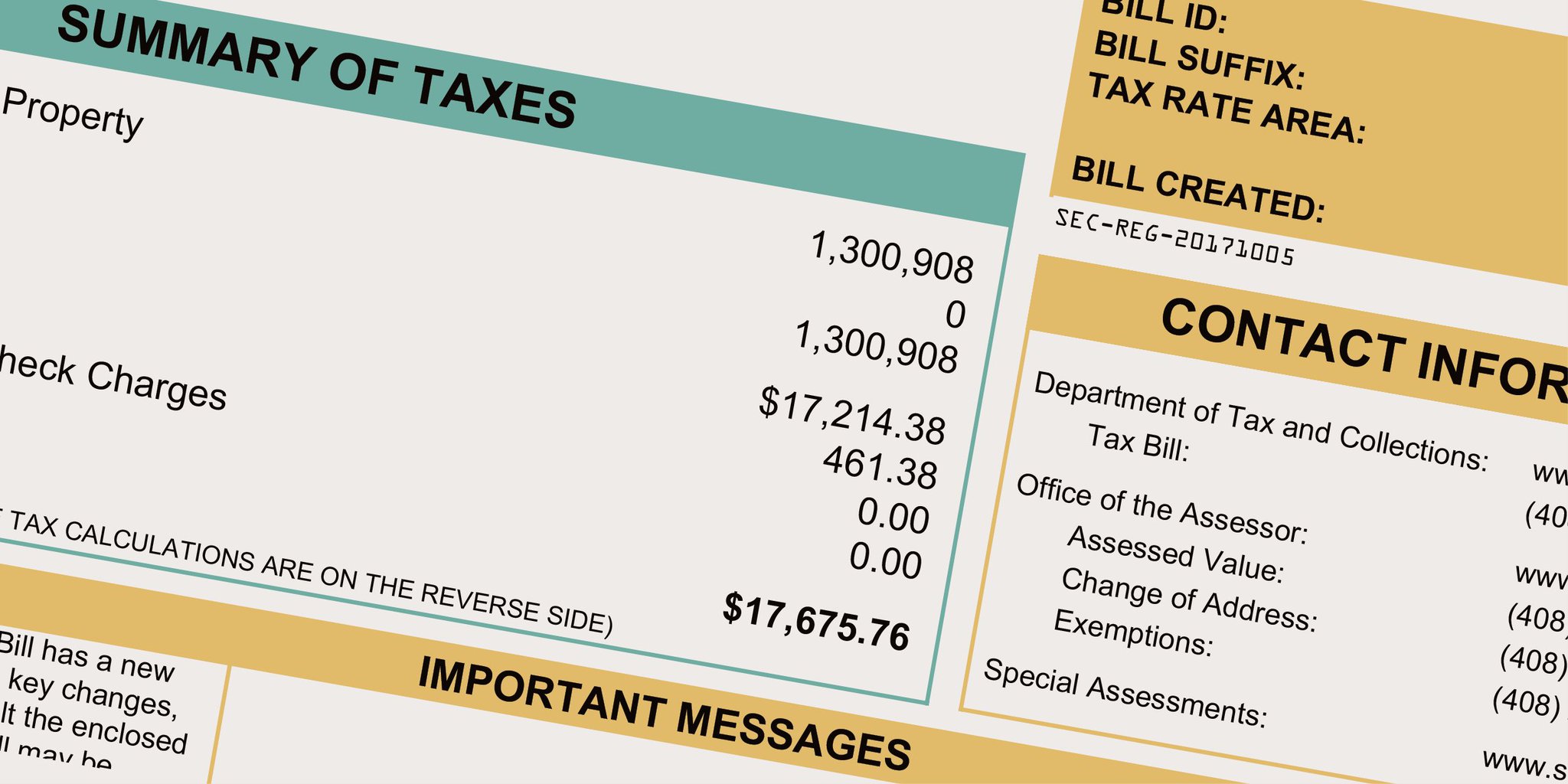

Yearly median tax in Santa Clara County. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. Elements of Property Taxes.

We Provide Homeowner Data Including Property Tax Liens Deeds More. Property Tax Rate Book. Ad Uncover Available Property Tax Data By Searching Any Address.

The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. In establishing its tax rate Santa Clara. The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022.

COUNTYWIDE 1 PROPERTY TAX DISTRIBUTION FY2020-21. Tax Rate Areas Santa Clara County 2022. Santa Clara County 1800.

Information in all areas for Property Taxes. When not received. 0720 of Assessed Home Value.

Other Taxes and Fees There will also be a transfer tax based on the value of the property and the rate will vary throughout California. For Santa Clara County the rate is 055 per every 500. Three groupsCounty Assessor Controller-Treasurer and Tax Collectoradminister the Countys property taxes.

San Jose California 95110. The Assessor is responsible for establishing assessed values used in. The bills will be available online to be viewedpaid on the same day.

Compilation of Tax Rates and Information. TAX RATES The tabulation below and continued on the next page represents a summary of the various tax rates levied in the County of Santa Clara for the Fiscal Year 2020-2021. The chart shows the Countywide distribution of the 1.

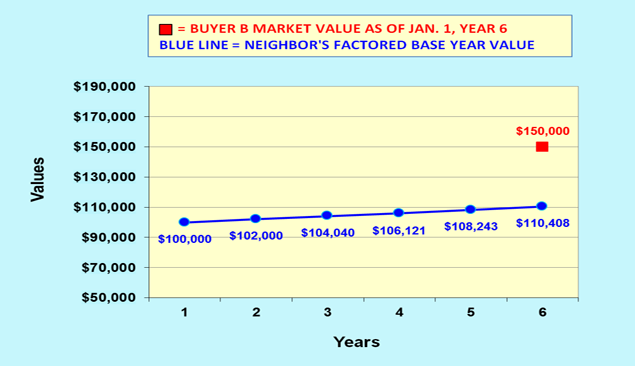

Santa Clara establishes tax rates all within the states regulatory guidelines. Property Taxes are made up of. Proposition 13 1978 limits the property tax rate to one percent of the propertys assessed value plus the rate necessary to.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The median property tax in Santa Clara County California is 4694 per year for a home worth the. 0 Down VA Loan.

A tax rate area TRA is a geographic area within the jurisdiction of a unique. However left to the county are evaluating property issuing bills collecting the levies carrying out compliance. Santa Clara County collects on average 067 of a propertys.

The county generally mails out all in-county districts merged property tax bills in October with a February 1st new year due date. With this resource you will learn useful facts about Santa Clara County property taxes and get a better understanding of what to consider when it is time to pay. Tax Rate Book Archive.

Secured Property Taxes Treasurer Tax Collector

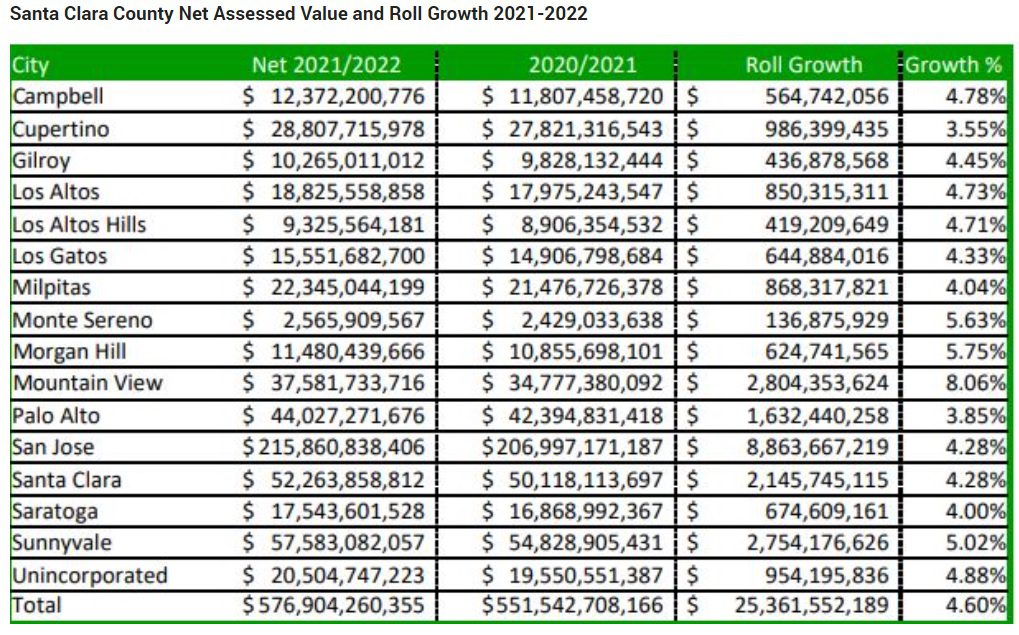

Santa Clara County Sees Increase In Value Of Taxable Properties San Jose Spotlight

Understanding California S Property Taxes

Op Ed Who S Exempt From Parcel Taxes In Santa Clara County San Jose Inside

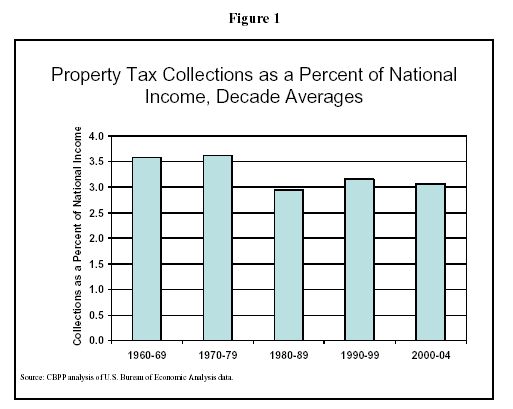

Property Taxes In Perspective Center On Budget And Policy Priorities

What You Should Know About Santa Clara County Transfer Tax

Transfer Property Tax Base Ca Propositions 60 90 And 110 Remeo Realty

Property Assessments Reach 551 5 Billion Peak Of Santa Clara County Economic Growth San Jose Spotlight

Santa Clara County California Ballot Measures Ballotpedia

California Sales Tax Rate Rates Calculator Avalara

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Tax Calculator Smartasset

Notification Of Supplemental Assessment How Property Tax Works When You Purchase A House Brian Dan Sereno Group

County Of Santa Clara Al Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future

Scc Dtac By County Of Santa Clara

Company Rates Stanislaus County In Top 10 Where Property Taxes Go Farthest Ceres Courier

Santa Clara County Ca Property Tax Calculator Smartasset 2022